tax shelter real estate definition

Someone who thinks a feature of the tax code giving taxpayers the ability to reduce taxes is not. A tax shelter is a vehicle to reduce current tax liability by offsetting income from one source with losses from another source.

Tax Shelters For High W 2 Income Every Doctor Must Read This

An investment that produces relatively large current deductions that can be used to offset other taxable income.

. AK Alaska Real Estate Exam Prep. An entity such as a partnership or investment plan formed with tax avoidance as a main purpose. An interest offered or purchased on the premise that it will provide favorable tax consequences purchased limited partnership tax shelters Source.

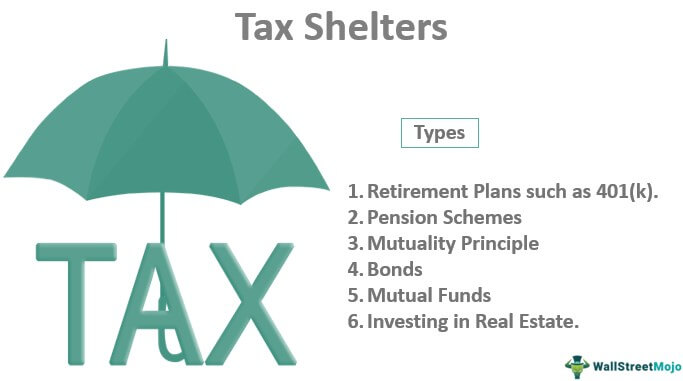

Turning back to Merriam-Webster a tax shelter is defined as. There is a penalty of 1 of the total amount invested for the failure to register a tax shelter. Shelters range from employer-sponsored 401 k programs to overseas bank accounts.

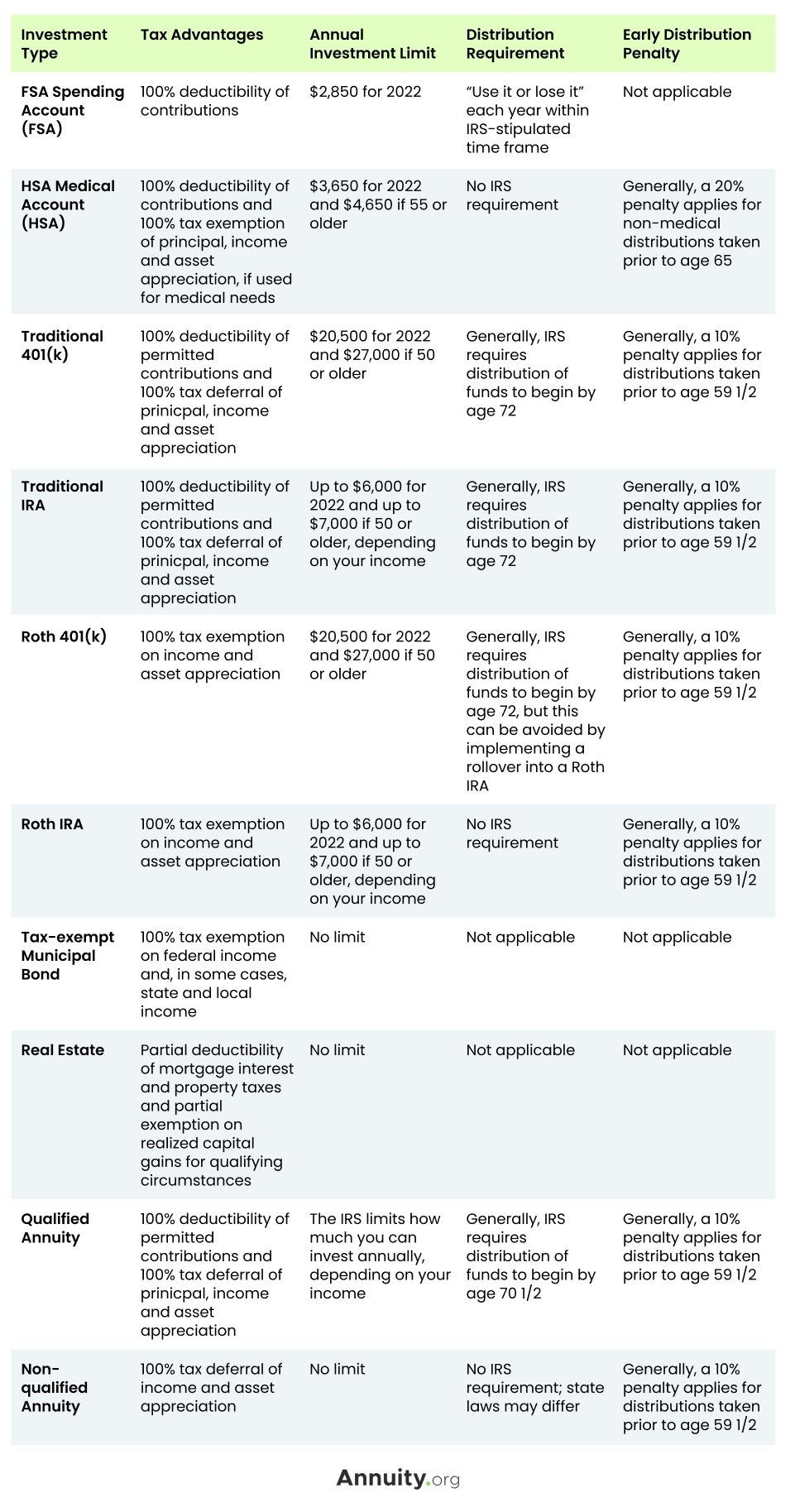

An interest offered or purpose with the goal of providing favorable tax consequences. For example there are several retirement plans available for any individual to opt for that help reduce tax liabilities. Tax shelters are ways individuals and corporations reduce their tax liability.

Abusive tax shelters are a consequence that resulted from Congress allowing losses of revenue to be used for tax benefits. A tax shelter is a legal method of reducing a taxpayers taxable income. 461i3 provides that the term tax shelter.

A tax shelter is defined differently under various Code sections with one of the broadest definitions used in this case. A tax shelter is advantageous by the taxpayers in high tax brackets so they can take losses from it to reduce their taxable income. Traditional tax shelters have included investments in real estate oil and gas equipment leasing and cattle feeding and breeding programs.

Definition of Abusive tax shelter. Murphy Real Estate Agent Keller Williams Realty Atlanta Metro East. Tax shelters can be both legal illegal.

Many people think of tax shelters negatively but they are completely legal and legitimate ways to decrease your taxable income. However when the claims are exaggerated those tax deductions change. An interest offered or.

Types of Tax Shelters Investments. A tax shelter is a place to put your money where it will be safe from the long arm of the Tax Man. An entity as a partnership or investment plan or arrangement whose principal purpose is the avoidance or evasion of income tax also.

They are a side-effect of tax deductions that companies are entitled to claim. A tax shelter is a vehicle used by individuals or organizations to minimize or decrease their taxable incomes and therefore tax liabilities. Legal Definition of tax shelter.

A number of real estate tax shelter exist. DE Delaware Real Estate Exam Prep. The IRS allows some tax shelters but will not allow a shelter which is abusive.

A tax shelter is a legal way of investing in certain plans or schemes that reduce the overall taxable income of the taxpayers and therefore save the taxes that are paid to the state or federal governments. Tax shelters are any method of reducing taxable income resulting in a reduction of the payments to tax collecting entities including state and federal governments. AR Arkansas Real Estate Exam Prep.

448a3 prohibition defines tax shelter at Sec. The phrase tax shelter is often used as a pejorative term but a tax shelter can be a legal way to reduce tax liabilities. AL Alabama Real Estate Exam Prep.

CO Colorado Real Estate Exam Prep. In 2022 employees can make up to 20500 in deductible contributions to a 401 k with workers age 50 and older entitled to deduct an additional 6500 in catch-up contributions. 448d3 which states that the term tax shelter has the meaning given such term by section 461i3 Sec.

The methodology can vary depending on local and international tax laws. View the definition of Tax Shelter and preview the CENTURY 21 glossary of popular real estate terminology to help along your buying or selling process. Homeless animals aside tax shelters are in place to well help reduce taxable income.

Common examples of tax shelters are home equity and 401k accounts. See also abusive tax shelter. An entity as a partnership or investment plan or arrangement whose principal purpose is the avoidance or evasion of income tax also.

CA California Real Estate Exam Prep. Tax shelter definition any financial arrangement as a certain kind of investment or allowance that results in a reduction or elimination of taxes due. Popular tax shelters include real estate projects and gas and oil drilling ventures.

A tax shelter as cumulatively defined by IRC Sections 448 1256 and 461 is any partnership or entity other than a C corporation that has more than 35 of losses in a tax year allocable to limited partners or limited entrepreneurs. Merriam-Websters Dictionary of Law 1996. CT Connecticut Real Estate Exam Prep.

A tax shelter is more or less like a financial vehicle through which taxpayers can safeguard their money. On the other hand tax evasion is used to lower the amount of taxes owned by using intentionally illegal methods that are considered a federal offense and punishable by law. The less taxable income an investor has the less they pay in taxes.

Sounds simple enough but how does this work in. In other words it is a type of legal strategy with the help of which an individual can lower their taxable income and hence reduce his or her tax-related liabilities. Tax Shelter tax shelter n.

The most widely used tax shelter in the US is the 401k. The failure to report a tax shelter identification number has a penalty of 250. Tax shelters are legal and can range from investments or investment accounts that provide favorable tax treatment to activities or transactions that lower taxable income through deduc.

A tax shelter is a means of minimizing tax liability. AZ Arizona Real Estate Exam Prep. A limited entrepreneur is considered any business owner who is not actively engaged in the operations or.

A tax shelter is different from a tax haven which is a place outside. A tax shelter is used to lower the amount owed in taxes in a legal manner as defined by the IRS and the tax code. Pick a state where youre taking your Real Estate Exam.

It can be understood as a financial vehicle or legal strategy or any method applied with a full conscience for the purpose.

What Is It Real Estate Is Land And The Buildings And Improvements On Land By Definition Real Estate Includes Natural Assets Such As Minerals Under Ppt Video Online Download

What Are Tax Sheltered Investments Types Risks Benefits

What Is A Tax Shelter And How Does It Work

What Is The Definition Of Tax Shelter Business Interest Expense

The Top Tax Court Cases Of 2018 Who Qualifies As A Real Estate Professional

Tax Shelter Definition Examples Using Deductions

Tax Shelter Difference Between Tax Shelter And Tax Evasion

How Physicians Can Shelter W 2 Income With Real Estate Professional Status Reps

What Is It Real Estate Is Land And The Buildings And Improvements On Land By Definition Real Estate Includes Natural Assets Such As Minerals Under Ppt Video Online Download

9 Legal Tax Shelters To Protect Your Money Gobankingrates

Tax Shelters For High W 2 Income Every Doctor Must Read This

What Is It Real Estate Is Land And The Buildings And Improvements On Land By Definition Real Estate Includes Natural Assets Such As Minerals Under Ppt Video Online Download

Tax Shelters Definition Types Examples Of Tax Shelter

What Are Tax Sheltered Investments Types Risks Benefits

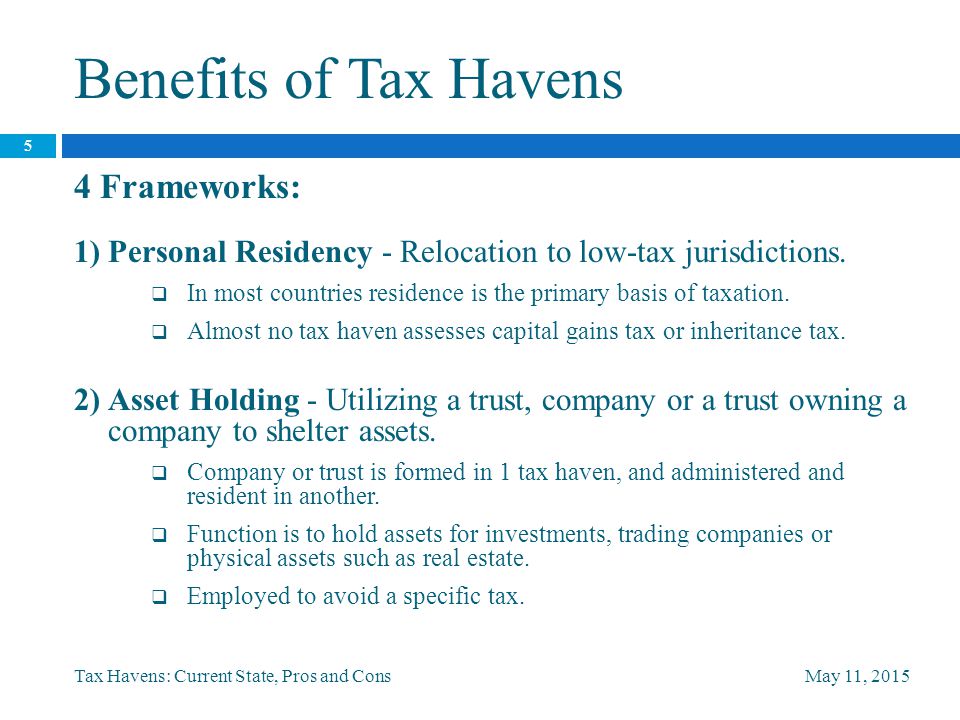

Tax Havens Current State Pros And Cons By Maria Gabriela Calderon Arnaldo Busutil And Anturuan Stallworth April 12 Ppt Download

What Is It Real Estate Is Land And The Buildings And Improvements On Land By Definition Real Estate Includes Natural Assets Such As Minerals Under Ppt Video Online Download